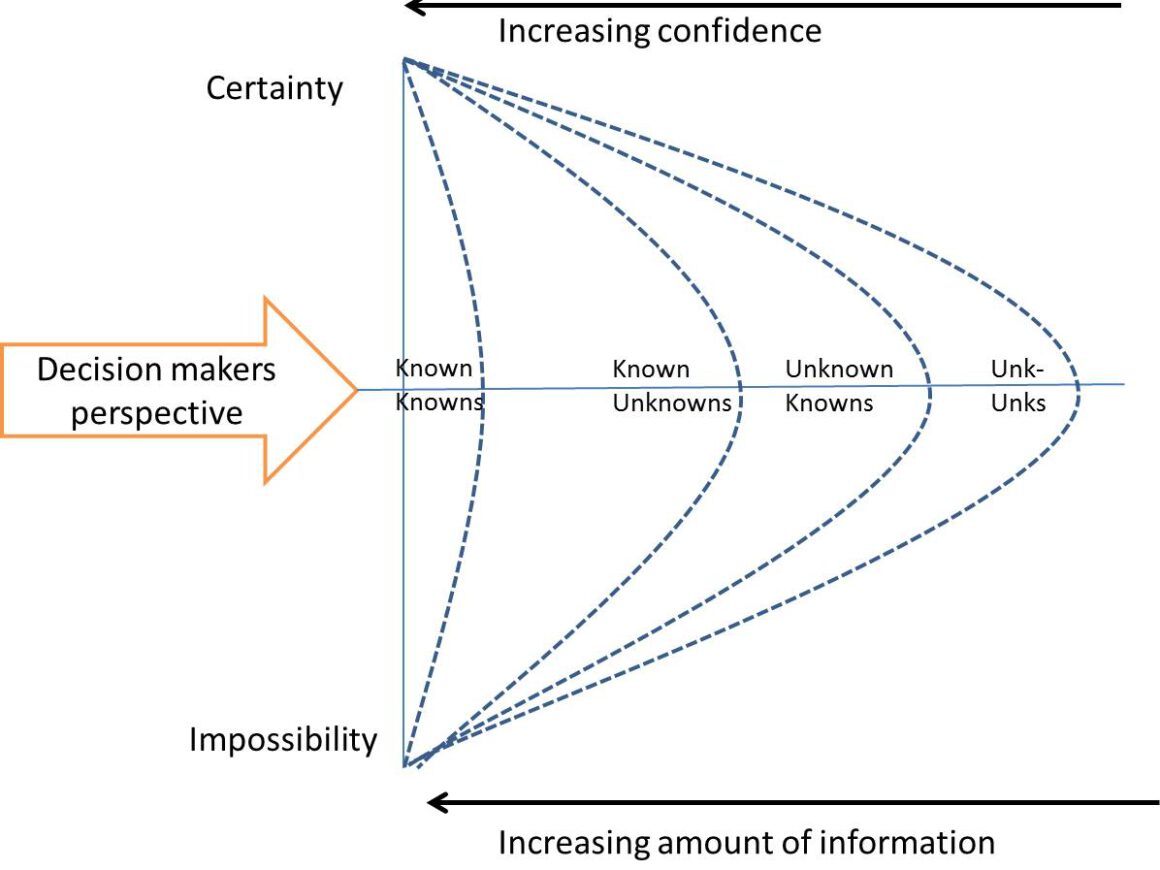

This is the cognitive risk model Winch uses in Managing Construction projects (Winch 2010 p. 349). His reasoning is somewhat sophisticated and I tried to make sense of it by using my own words. Maybe it is of help for my students.

This is the cognitive risk model Winch uses in Managing Construction projects (Winch 2010 p. 349). His reasoning is somewhat sophisticated and I tried to make sense of it by using my own words. Maybe it is of help for my students.

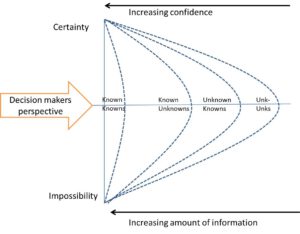

Look at the model. From the viewpoint of a manager, (the decision-maker) a future incident can happen (with certainty) or will not happen at all (impossibility). Somewhere in between lies reality. If sufficient information is available, the manager should be able to objectively predict that a certain incident will happen, when it will happen, and he will know its impact. If so, we deal with a Known Known, represented at the left side of the model. Winch calls this a risk because the incident is definable, the source and the effects are known. The manager is confident he understands the risk and he takes the right management decision and proceeds with the project. Problem solved!

In reality, sufficient data is often not present, future conditions are hardly ever fully known, the context is partly out of sight. Especially in the building industry. Even if there is abundant information available the context could easily change or new and additional information is unveiled later. An “unknown” component comes into play and we shift to the right side of the model. On the right side, we deal with uncertainties and not with risks because the incident is not fully definable. Uncertainties can be partly defined or not at all because we do not know them (Unk-Unks).

A manager will have a certain perception of the information at hand. He/she will make sense of the information available and he/she will judge and act based on it. Does he/she value the event as a risk or as an uncertainty?

According to Winch, the cognitive model differs from other risk management approaches in two ways: first, it makes explicit what is often implicit. Dealing with risks or uncertainties is fundamentally a function of our perceptions. Risk is not something out there but dependant on the information available and the decisions made. Second, it makes visible the difference between, on the one hand, the probability of an event to happen. Then it is a risk because probability and impact are definable. And, on the other hand, the condition that the probability can’t be defined. Then we speak of uncertainty: when we cannot define probability or impact. Differently stated: it is going to happen! Or we don’t know if something will happen or not.

Known-Knowns. Is the cognitive condition of risk: the risk source is defined, the probability assigned.

Known-Unknowns; is the cognitive condition of uncertainty where the source can be defined but the probability or impact not. For instance the condition of the subsoil of a plot of land. We know that most subsoil in Amsterdam is contaminated but where the contamination is precisely or how bad it is, is often not known. We know a schedule is a possible representation of the future and we know it will change. But what will change and when is unknown.

Unknown-Knowns, Is the cognitive condition of uncertainty where someone knows about a risk source but holds the information private and does not share it with the team, client, or manager. An example being a strategic misrepresentation. Another example is “information asymmetry” discussed in week two, related to the principle-agent problem and the briefing problem.

Unknowns-unknowns (unk-unks) Is the cognitive condition of uncertainty where the risk source has not been identified and the risk event, therefore, cannot be known. This phenomenon is called a ‘black Swan”.

It was remarkable to me that Winch states that known knowns are “the area of most contention”. Remarkable because I thought that if you know the risk then you can act! You know what to do.

The bulk of future events are uncertainties because reality is often different from theory or plan, context changes, not all data is available, decisions are made based on our personal perceptions, experience, etc. Decisions are often (very) subjective and therefore object of dispute. Overly optimistic project managers, therefore, value incidents as risks and not as uncertainties, placing a risk event in the “known-known sphere” while it needs to be in the unknown sphere. Maybe then making the wrong decision or taking the wrong actions because they think they oversee the problem while they do not. Maybe the contention Winch refers to is about the dispute you can have about this.